FIGS, Inc. (FIGS) Deep Dive

The Next Great Cult Apparel Company

FIGS is a luxury medical apparel company selling scrubs and other medical equipment to nurses, doctors, and other medical professionals. Its mission is to celebrate, empower, and serve those who serve others.

The LA-based scrubs-maker has built the largest DTC platform in the healthcare apparel industry. They've turned an otherwise commodity product (scrubs) into a fashion/status symbol with passionate superfans. Since its inception, FIGS has raised a mere $60M in outside capital to fund its growth.

Why FIGS Matters: FIGS is the only company serving the niche healthcare apparel space. They care deeply about the end consumer, the healthcare worker. The company is obsessed with creating the best products for its healthcare workers. Larger competitors will not compete with FIGS because it can't shift its brand strategy to serve a small, niche community.

E-commerce is uniquely advantageous for healthcare apparel customers. These customers work 12-hour shifts and can't shop during "normal" business hours. So instead, FIGS built its business through digital DTC connections with routine monthly apparel "drops" and consistent customer engagement.

Over time, FIGS will open physical retail stores within five miles of a hospital, allowing healthcare professionals to touch, feel, and try on the fabric in person.

The FIGS model works. The company's grown from 300K to 1.5M active customers generating over $260M in revenue with 70%+ gross margins and 26% adjusted EBITDA margins.

Assuming its mid-range price-per-share guidance, FIGS will trade at a ~$2.7B Enterprise Value or ~10x current sales.

Our Variant Perception: FIGS isn't another commoditized medical apparel company. Rather it's the next apparel cult in the making. Medical professionals spend all day with one another. They want to look good, and more importantly, they want to feel a sense of community and gain social status.

FIGS fulfills both as it makes luxury products that look good and are tailored to the healthcare professional. If one nurse starts wearing FIGS scrubs, there's a good chance others will follow. In turn, the company can spend little on customer acquisition while ruthlessly focusing on serving its customer: the healthcare professional.

The company currently has ~2% of its addressable market. Lacking any real competitors in the space, we see a path towards $1B in revenue, $100M+ in free cash flow, and a ~12% market share in healthcare apparel over the next ten years.

Creating Cults From Commodities: A Primer

It's hard to lose money betting on cults. Tesla, Lululemon, Peloton, or Yeti. Our bull thesis hinges on this one assumption: that FIGS will create a cult around healthcare apparel. That's it. If we get that right, we'll make a lot of money in the stock.

The recipe for cult-like success is simple. Take a commoditized item (cars, workout clothes, stationary bikes, and coolers) and make it a social status symbol. Now, you don't just drive any vehicle; you drive a Tesla. You're not working out in sweats, but Lulu gear. That stationary bike? It's not a clothes-hangar; it’s a Peloton -- a portal into a community of bike-fitness freaks.

Remove the brand, and you kill the cult.

But here's the kicker: not every commodity product can (or should) be a cult. Cults form around sociable products. Items you can bring to a friend's house or post on Instagram. Nobody's hash-tagging their latest toilet paper purchase, and for a good reason. We only share things that give us "points" in life's never-ending social status game.

Traditional scrubs are bland, boxy, and shaped to fit the cover of an Airstream. Yet healthcare professionals must wear them on the job. This makes healthcare apparel the perfect product for the next cult movement. FIGS emphasizes this in its S-1, saying:

"Hospitals and other healthcare institutions, which often employ thousands of healthcare professionals working in close physical proximity on a daily basis, serve as ideal environments for growing awareness of our brand through word of mouth."

Traditional Healthcare Apparel Distribution Stunts Brand Growth

Healthcare apparel is a boring industry shackled with six significant issues (from FIGS's S-1):

Commoditized products (which we covered above)

Brand Obscurity

Antiquated Distribution

Channel Conflict

Customer Separation

Challenged Margins

Each issue above is highly correlated to one factor: control of distribution. Traditional scrubs manufacturers sell their products under third-party licenses. These third-party companies resell the scrubs through an antiquated distribution model that involves discount brick-and-mortar retail stores in inconvenient locations for healthcare professionals.

Adding the extra step of a third-party distributor removes the manufacturers’ chances of developing a real relationship with its customers. Even if they wanted to go DTC, many wholesale manufacturers have relationships/contracts with third-party distributors to not offer a DTC option.

Incumbents pay the price for this model, which includes higher third-party licensing fees, unattractive wholesale unit economics, and a lack of investment in product R&D. The result? Lower margins, higher churn, and no brand loyalty.

FIGS avoided each of these issues by choosing a DTC, fully E-commerce model.

The FIGS DTC Model: Perfect For Healthcare Apparel

FIGS's DTC e-Commerce model is perfect for the healthcare apparel industry. First, it strips third-party licensing agreements, allowing FIGS to control its product quality, distribution, and brand loyalty. Next, it removes any channel conflict with legacy wholesale partners.

FIGS doesn't need an intermediary wholesaler because they sell directly to the consumer. Removing these middlemen allows the customer (I.e., the healthcare professional) to play a central role in the product development process. For example, FIGS customers can provide feedback on product quality, tastes, and ideas for new designs directly to the manufacturer.

The company generates incrementally higher gross and net profit margins by removing the unnecessary costs from an antiquated distribution model.

There is one primary reason why a DTC E-commerce model structurally benefits healthcare apparel: odd working hours.

Healthcare workers routinely pull 12-to-24 hour shifts, and most stores are closed when For example, end. This makes it difficult for healthcare workers to get the uniforms they need when they need them.

FIGS says it best in its S-1 filing (emphasis mine):

"Unlike most incumbent scrubs manufacturers, who sell through legacy distribution channels and do not have direct touchpoints with the end customer, we directly engage with and serve medical professionals through our digital platform. By owning all aspects of the customer experience, including website and app design, marketing content, storytelling and post-purchase customer engagement, we deliver an elevated, personalized and seamless experience."

One of the (many) benefits of a DTC model is the ability to create product demand instantly through merchandise drops (or "Merch Drops"). The Merch Drop model is simple with two ingredients: a new product and scarcity.

Each week, FIGS drops limited edition colors and styles of its favorite core products. These limited-time drops drive massive amounts of organic traffic to FIGS's platform, where customers can grab a spot in line for the drop while they browse for other items.

Merch drops spur interest in the limited edition products and increases the purchasing frequency of FIGS's most popular items. Here's a snippet from the S-1 explaining this phenomenon (emphasis mine):

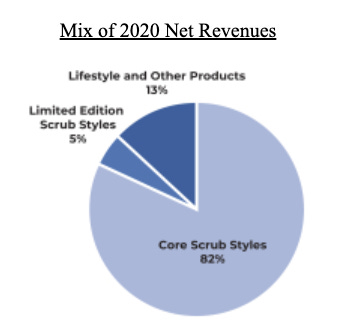

"These launches not only drive interest in the limited edition products themselves, they also drive our core business, as, on average, 90% of sales on launch days are core styles. This innovative, lower-risk merchandising strategy drives recurring demand while maintaining inventory efficiency."

As of 2020, the company sports a +81 NPS rating.

How FIGS Grows From Here

Co-founders Heather Hasson and Trina Spear started FIGS by selling scrubs out of the back of a car. They traded marketing dollars for product development and created the best scrubs on the planet.

In 2020, FIGS generated $263.1M in revenue with 72% gross margins and 26% adjusted EBITDA margins. The company has a ~2% market share in the current $12B healthcare apparel market.

According to Frost & Sullivan, the healthcare apparel market is expected to grow by a ~6% CAGR over the next five years to reach $16B in 2025.

The question we must ask is how much market share FIGS can take over the next five years? Here's a simple way to think about it. If FIGS triples its market share by 2025, they're a $1B run-rate revenue company. If they double market share, they're a $700M run-rate revenue business.

There are five levers FIGS can pull to hit those growth rates.

Lever 1: Expand existing customer repeat purchase frequency

FIGS customers are sticky customers. Check out these stats:

50% of customers acquired between 2017 and 2019 returned for a second purchase

63% of second-purchase customers returned for a third purchase

70% of third-purchase customers bought the fourth item.

The lever here is simple. If you can increase the percentage of second-time buyers, you increase the percentage of third and fourth-time buyers.

This makes intuitive sense as scrubs are required uniforms in nearly every healthcare profession.

Lever 2: Find New Customers & Increase Brand Awareness

Males comprise ~25% of the nurse professionals (according to company S-1). So it makes sense that FIGS's men's business represents just 17% of total revenue.

FIGS has only begun attacking the men's healthcare apparel market, opting (correctly) to focus on the more prominent female demographic. FIGS also has 55% aided and 22% unaided brand awareness, according to a Frost & Sullivan survey.

There are myriads ways the company can increase its brand awareness. For example, it could partner with medical schools to outfit students in school-branded FIGS scrubs. In addition, it can create in-hospital pop-up shops so nurses and doctors can easily touch, feel, and try on the latest products.

In fact, it's already done this with Children's Hospital of Los Angeles and the Herman Ostrow School of Dentistry of USC.

Lever 3: Expand Into New Product Offerings

FIGS is stealing a page from LULU's playbook with this lever. LULU successfully added new work-specific clothing options like the ABC pant and even a full button-down dress shirt. Remember, FIGS has a sticky, cult-like following.

This makes it easier to cross-sell "Lifestyle" pieces like loungewear, socks, and other items. Healthcare workers are passionate about their careers -- it’s what defines them. So why not always rep the brand that celebrates your career passion?

Lever 4: Enter International Markets

FIGS has barely tapped the $67B international healthcare apparel market. The company started selling products in the UK, Australia, and Canada just last year. FIGS is deliberately testing global expansion (they don't want to grow for growth's sake). Here's an example of the company's specificity with international development (emphasis mine):

"In order to offer a more localized experience to customers internationally, we plan to launch products that are specific to local markets and digital experiences that are tied to local culture."

It's important to note that we aren't including any international revenue growth in our valuation estimates.

Lever 5: Enter New Professional Uniform Markets

Outside the healthcare apparel industry, FIGS sees long-term opportunities to enter other uniform-wearing professions. I don't like this lever and hope they never pull it. A large part of FIGS's brand loyalty comes from the fact that they obsess over healthcare professionals.

The company's sole mission is to equip "Awesome Humans" with products to help them perform. Would FIGS have the same brand loyalty feel if they shifted to construction uniforms or school uniforms? My bet is no.

FIGS has all the ingredients to create a cult-like product and the growth levers to reach $1B in revenue over the next 5-10 years. Next, we'll examine the company's cash-generating capabilities with our Cash Flow Variance Model.

FIGS's Cash Flow Analysis

Most of my quantitative "valuation" work comes in analyzing the health of a company's cash flows using a Cash Flow Variance model. Suppose you haven't heard of it before. In that case, I suggest reading Part 1 and 2 of my Cash Flow Variance breakdown or my Roblox analysis essay (disclosure: I am a shareholder of RBLX in my personal account at the time of writing).

FIGS has grown revenue from $54M in 2018 to $263M in 2020 for a 129% 3YR CAGR. Going forward, we'll only use 2019-2020 data as the S-1 has all data needed for both those years to complete our Cash Flow Variance analysis.

We can bifurcate FIGS's cash flow analysis into two main categories:

Growth: The rate of change in the underlying category

Operating Efficiency: The pace of change in the margin percentage of the underlying category

First, we determine Operating Cushion, which is simply Gross Profit minus all SG&A expenses.

In 2020 FIGS generated $263M in revenue and $190M in gross profit. However, it spent $132.8M in SG&A, leaving us with ~$42M in Operating Cushion (22% margin). You can see the sheet below:

To compare, FIGS generated a -0.31% Operating Cushion in 2019.

From here, we add our working capital requirements as a percentage of revenue (see below):

As you can see, inventory build-up ate a lot of FIGS's available cash flow, leaving the company with a ~6% Core Operating Growth margin. In other words, for every $1 FIGS generates in revenue, it earns $0.06 in core operating cash flow.

Finally, we arrive at Core FCF Growth by subtracting capex and taxes paid (again as a percentage of revenue).

This gives us a ~2.14% in FCF Growth margin. Said another way, if FIGS maintains this model next year, every $1 in incremental revenue will translate to ~$0.02 in free cash flow.

I know what you're thinking -- "But Brandon, those are such low Core Operating/FCF Growth margins. Why should I care?"

You should care because FIGS's business model works at scale. For example, in 2019, FIGS spent ~70% of its revenue on SG&A expenses. Last year it spent ~50% of revenue on SG&A while generating $152M more in sales.

In sum, FIGS's $152M increase in revenue resulted in a positive $10.14M in freely available cash.

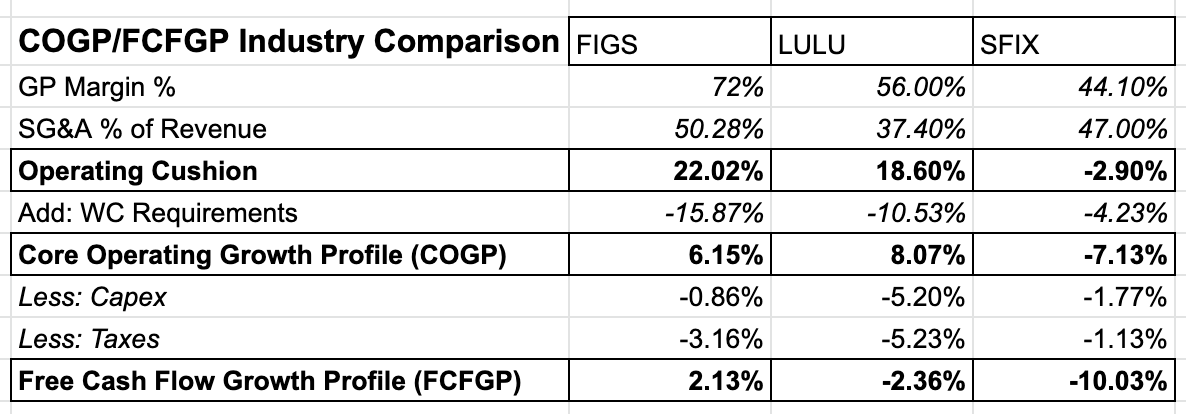

Comparing FIGS To LULU & SFIX

How do FIGS's cash flows compare against Lululemon or another DTC e-commerce business like Stitch Fix? Let's find out.

Here are the results:

LULU has the highest Core Operating Growth margin at 8%, yet FIGS sports the highest Free Cash Flow Growth Profile margin at 6%. This makes intuitive sense because FIGS fully DTC E-commerce model, which allows them to generate higher gross margins.

There are many questions we should ask at this point, like "is FIGS's GM % sustainable and how does that evolve over time?" or "Will FIGS reduce its SG&A expenses in line with LULU around 35-40%?"

We can’t answer those questions with any level of specificity, but we can estimate what we think FIGS is worth.

What's FIGS Worth?

As we mentioned earlier, FIGS should open at a ~$2.7B EV for a 10.2x current sales multiple. Let's assume the company can grow to $1B in revenue by 2030. What would that look like, and what would FIGS be worth in that scenario?

To get to $1B in revenue by 2030, FIGS would need to grow its top-line roughly 56% per year for the next five years (I know, it's asking a lot). Let's also assume that the company maintains ~70% gross margins but improves its SG&A spending to ~40% of revenues, drifting in line with the LULU's of the world.

Now we have a $1B run-rate revenue company generating $300M in operating earnings (30% margin).

Next, let's assume the company maintains a roughly -16% working capital requirement. Again, this is higher than LULU and SFIX and assumes the company continuously carries higher-than-needed inventory levels.

Subtracting our working capital gets us ~$150M in Core Operating Cash Flow. Then, deduct another 4% for taxes and capex, and you get ~$110M in free cash flow.

Assuming all the above, the investor is still paying ~25x our estimate of 2030 FCF. Then, hopefully, Mr. Market collapses the share price, giving investors the chance to buy FIGS under 15x our estimate of 2030 FCF.

This is one of those situations where we absolutely love the business, not the valuation. Yes, the company’s grown revenues at a 100%+ 3YR CAGR. And yes, they’re expanding operating margins. But we don’t want to pay 10x current sales or 25x our 2030 FCF estimates.

We’d love to buy shares at a $2B EV or lower, giving us a ~18x multiple on our 2030 FCF estimates.

Concluding Thoughts

FIGS is a fantastic business creating a cult around an otherwise commoditized product in a $69B global addressable market. The company is the world's first DTC online platform specifically designed for healthcare professionals.

FIGS has many levers to pull to reach billions of dollars in revenue and the unit economics to generate loads of free cash flow. Plus, the market loves cult-like businesses, and FIGS is the next great cult apparel brand.

Great article! I do have a few questions though:

1. When you said, "To get to $1B in revenue by 2030, FIGS would need to grow its top-line roughly 56% per year for the next five years", why are you only compounding the top-line for 5 years when this is a 9 year period?? Over 9 years the CAGR would only need to be high-teens to achieve this objective?

2. You know the WC will drop (as a %) as inventory becomes larger and there will be less variance in inventory from a percentage basis? Lulu, which has inventory in stores for heaven's sake, is at 10%! Stores require a stupidly larger amount of inventory between in-store products and the amount you need to store at distribution centers to meet demand.

Putting these two together, say you get to $1 billion in 5 years and then compound at 15% for the remaining (not unreasonable) you get revenue of $1.75B (give or take). With WC of 10% (equal to LuLu's inherently higher WC of their structure, worst case), subtract taxes, and you get a FCFGP of greater than 10%. This means FCFGP of at least $175 million.

This still doesn't take into account international growth, product diversification, or the fact that a DTC brand will have their SG&A go way below 40%, due to low overhead expenses.

I liked your thesis but I'm curious what you think about these comments. Thank you for the article!