Liquidity's Effect On Volatility

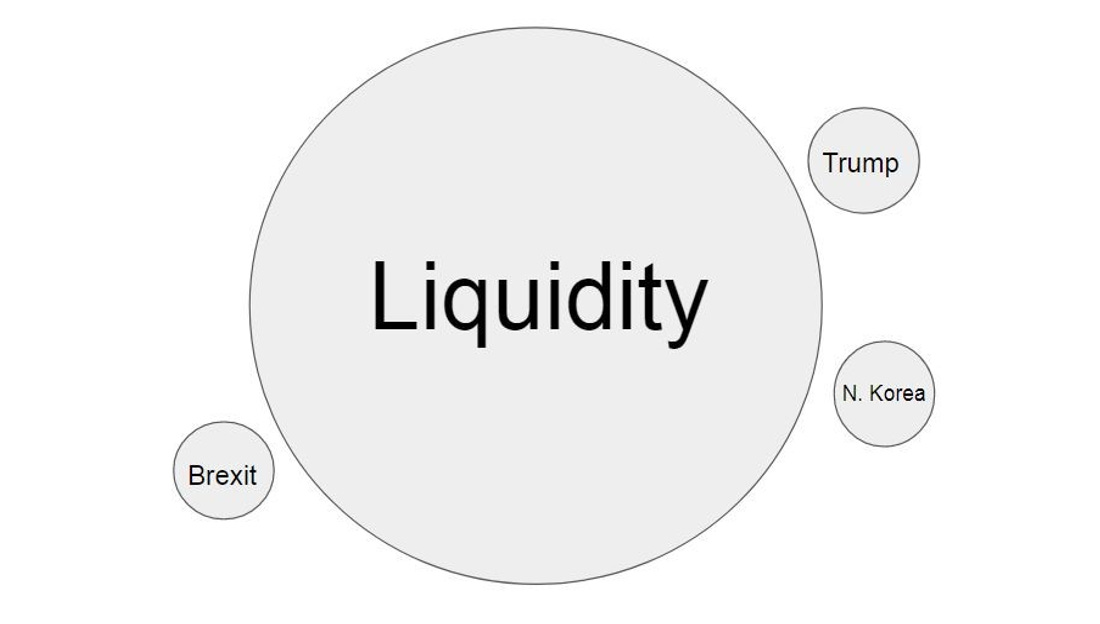

The proper way to analyze potential volatility conditions looks something like the picture below:

Current events and macro news come AFTER liquidity.

If markets have loose liquidity conditions, no amount of Trump tweets or White House shakeups will cause volatility. And if liquidity conditions are tight, no amount of good news can save markets from volatility.

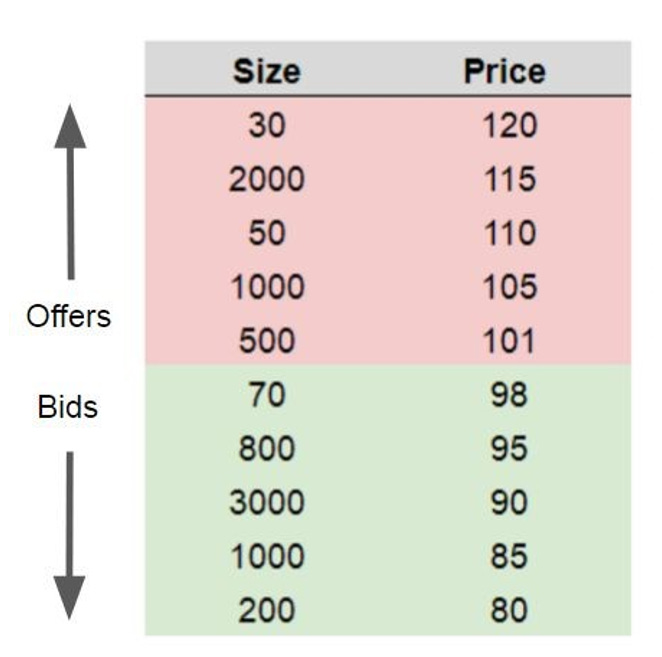

This makes intuitive sense when you look at how liquidity impacts market microstructure. Every market, whether it be FX, bonds, commodities, or stock, has an order book with bids and offers that looks something like this:

It’s just a bunch of buyers and sellers displaying how much they’re willing to transact and at what price. When financial conditions are loose, with high liquidity, everyone has a bunch of cash and credit they need to put to work. All this demand flows into the market and stacks up the order book which compresses prices. A liquid order book looks something like this:

The difference between the bid and the offer is tight and there’s a lot of size at each price level. Price will bounce around in a modest range because the order book can easily absorb any incoming orders.

A liquid market translates into lower volatility.

The opposite happens when financial conditions are tight and the system is illiquid. Investors are no longer lined up to buy financial assets. They don’t have the cash or credit available.

During illiquid times the order book looks something like this:

So not only are buyers and sellers farther apart, they have less to buy and sell. Price will oscillate wildly between all these different values because there’s not much here to absorb new orders coming into the market.

An illiquid market translates into higher volatility.

This connection between liquidity and market microstructure is why we see moves in volatility follow liquidity so closely.

Higher black line = tighter liquidity conditions.

The last time liquidity conditions tightened was in 2014 and into 2015. During this time the Fed was winding down its QE program — sucking liquidity right out of the system.

The stock market struggled, the dollar strengthened, commodities dropped, and as you can see in the chart above, the VIX popped. It popped primarily due to tightening liquidity conditions.

Since then the market has adjusted to the absence of the Fed’s bond purchases. Liquidity conditions have improved and VIX responded by embarking on a sustained downtrend throughout all of 2016 and now into 2017.