Life's a Garden, You Dig?

Dirty Dozen Chart Pack

“There was a decision point. He didn't experience it as a decision point because for him it was obvious what to do. That's what 20 years of experience buys you. You build up all these patterns, you quickly size up situations, and you know what to do, and that's why it doesn't feel like you're making any conscious decisions.” ~ Gary Klein

Good morning!

In this week’s Dirty Dozen [CHART PACK] we look at policy failures and capital cycles driving commodity booms, dive into a global food shortage crisis, check in on rising yields and soon to be falling gold, before pitching a tractor stock with a big breakout, plus more…

**Note: Enrollment into our Collective kicks off today and will be running into the end of the week. The Collective is our full-kit soup-to-nuts service that provides research, theory, and a killer community that consists of dedicated traders, investors, and fund managers from around the world. We’ve been told that there’s nothing else like it on the web. If you’d like to tackle markets with our group (whom, I should note, has been having a great year in markets), then just click the button below and sign up. And, as always, don’t hesitate to shoot me any Qs!***

1. The following comments and chart are from Grantham at GMO (link to the report):

“The electric vehicle (EV) industry, for example, is likely to consume 15 times the current annual global lithium supply by 2050!... Nearly all of the investment to generate 30 or 40 years of power from a wind or solar farm is up front – whether measured in money, resources, or energy… Perhaps the last great irony of the fossil fuel era will be that going off fossil fuels, in the long run, will require using one more spurt of fossil fuels in the short run. The quicker we convert our power grid, the worse the energy squeeze will be, and we cannot risk moving slowly.”

2. This perfect storm in commodities is a product of, first and foremost, the Capital Cycle and the severe lack of investments in the things we literally can’t live without.

The chart below is from an update on the oil market sent out to Collective members over the weekend. CAPEX is still well below the already low levels which preceded the early 2000 oil boom. $250bbl+ here we come…

3. We’ve been aggressively trading the Ag market since the start of the year and recently added to our long positioning in Wheat, Corn, Sugar, and soon Soybean Oil. We are of the belief that we’re on a short path to a major global food shortage, growing civil unrest, and all of the geopol volatility that comes with it.

4. “Ukraine is one of the world’s biggest exporters of corn, wheat, and sunflower oil, flows of which are largely stalled. Grains exports are currently limited to 500,000 tons a month, down from as much as 5 million tons before the war, a loss of $1.5 billion… Disruptions in the flows of grains and oilseeds — staples for billions of people and animals across the world — are sending prices soaring”~ via BBG.

5. Dec 23’ Euribors have been selling off in lockstep with eurodollars, driving yields up. For a long time, EU yields acted as an anchor on US rates, keeping them from rising too far too fast. This was due to relative value flows that would circulate into USTs whenever their yields rose too much in comparison to EU yields which were pinned hard at the NIRP/ZIRP.

That is no longer the case which is one reason why US bonds are in free fall…

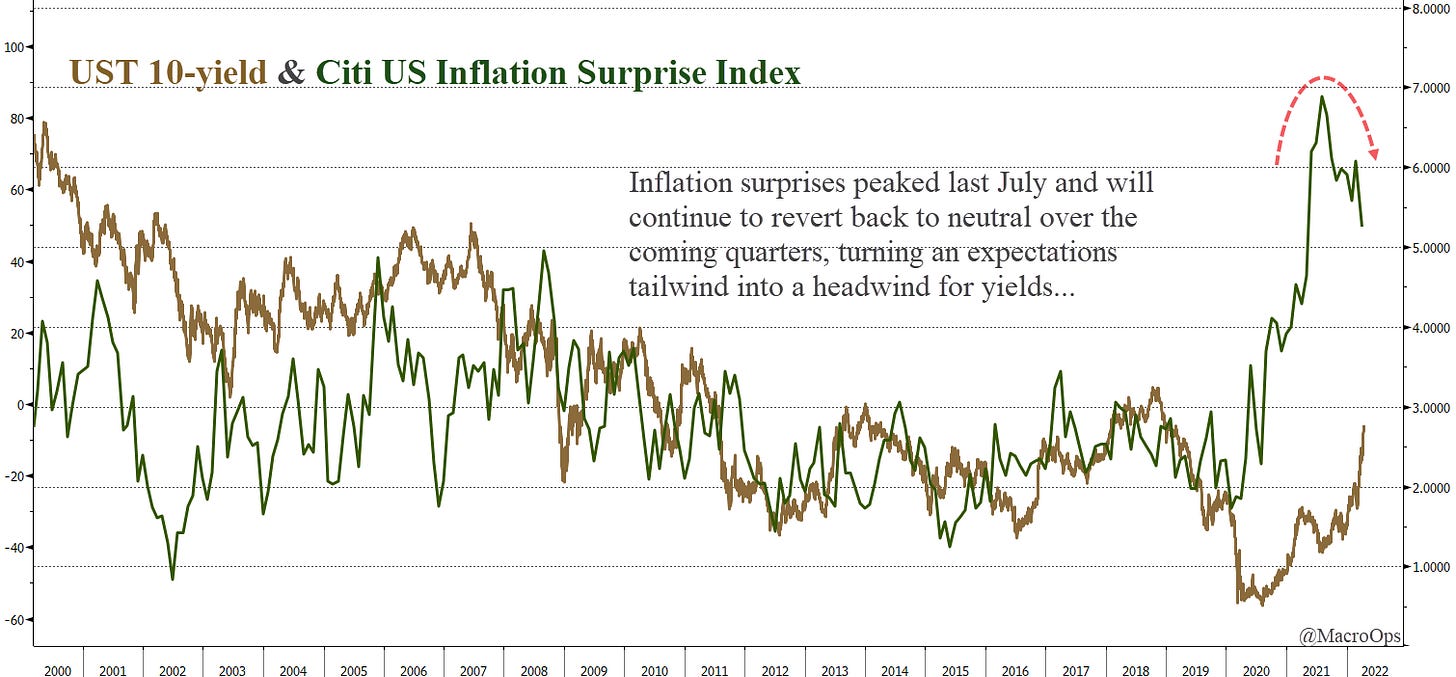

6. I think we probably see the 10-year cross 3% before finding a ceiling. I think we get there pretty quickly too. Somewhere along its path to 3% they’ll trigger another selloff in equities which will help put a bid back under bonds. Also, inflation surprises peaked last July and are quickly coming around suggesting the “Narrative Pendulum” has swung about as far as it's going to go this round…

7. Will a 90s style EM crisis soon be on the menu? “Despite the low global interest rates of the past decade, emerging markets’ external debt-servicing burden has been steadily climbing (Chart 2), with a sharp rise in 2020, as exports slumped, debt spiked, and borrowing terms deteriorated for many of these economies” from the IMF (link here).

8. Precious metals are facing major headwinds until bonds hit some support. Here’s 30yr real yields (inverted) against gold pointing the way lower.

9. Meanwhile, bullish positioning in the space is getting a bit over its skis…

10. There’s a lot of talk of a cyclical market top. I don’t think that’s in the cards (yet). Financial conditions are still entirely too loose so while we expect continued volatility in risk assets, we think they bottom in early summer after one more big shakeout.

The chart below from Credit Suisse shows US monetary conditions relative to the output gap.

11. Earnings revisions are turning negative adding another headwind to stocks (chart via Credit Suisse).

12. Sure, you can buy beaten-down tech and hope it stops falling through the floor (I mean, we are in very small size). But you can also just buy things in strong uptrends with incredible tailwinds, like John Deere (DE) here (chart is a weekly).

Thanks for reading.

Stay frosty and keep your head on a swivel.