Grains Cheatsheet

Part I out of III in our weekly miniseries...

Quick Summary

➢ Commercial year starts on September 1st and ends on August 31th.

➢ Grains are almost never a Buy and Hold (for a long term portfolio).

➢ Corn Dec, Soybean Nov are the New Crop futures.

➢ On a normal year October 1st, or the first Friday of October is the lowest point in price for the Soybeans and Corn market.

➢ Weather has an asymmetrical effect on crops. It doesn’t have to materialize to influence prices.

➢ Weather Risk Premium is the rise of prices due to concerns on production.

➢ Grain prices have a seasonal pattern, but this doesn’t mean that prices are easy to predict every year.

➢ Be aware of exports bans and laws like Ethanol quotas for Corn.

➢ During February, because of China’s New Year, Soybeans prices go down during festivities, then go up as they come back to the market.

➢ Corn to Soybean Ratio: if it’s over 3, it pays to grow soybeans.

➢ If the Contango is too steep there might be an opportunity for an old crop/new crop calendar spread

➢ Storage costs and arbitrage plays explain the shape of the contango forward curve.

➢ If the market is at backwardation there´s a supply concern and people need the grain now.

➢ WASDE is out the second week of every month.

➢ USDA is benchmark but be aware of consensus.

➢ Don’t focus on forecast numbers, focus on price reactions.

➢ Don’t follow the record crop trap.

➢ When open interest is trending down it is time to roll over.

Volatility Summary

➢ Prices Up, Volatility Up.

➢ Prices Down, Volatility Down.

➢ Stock to use ratio High, Volatility Low.

➢ Stock to use ratio Low, Volatility High.

Seasonality Summary

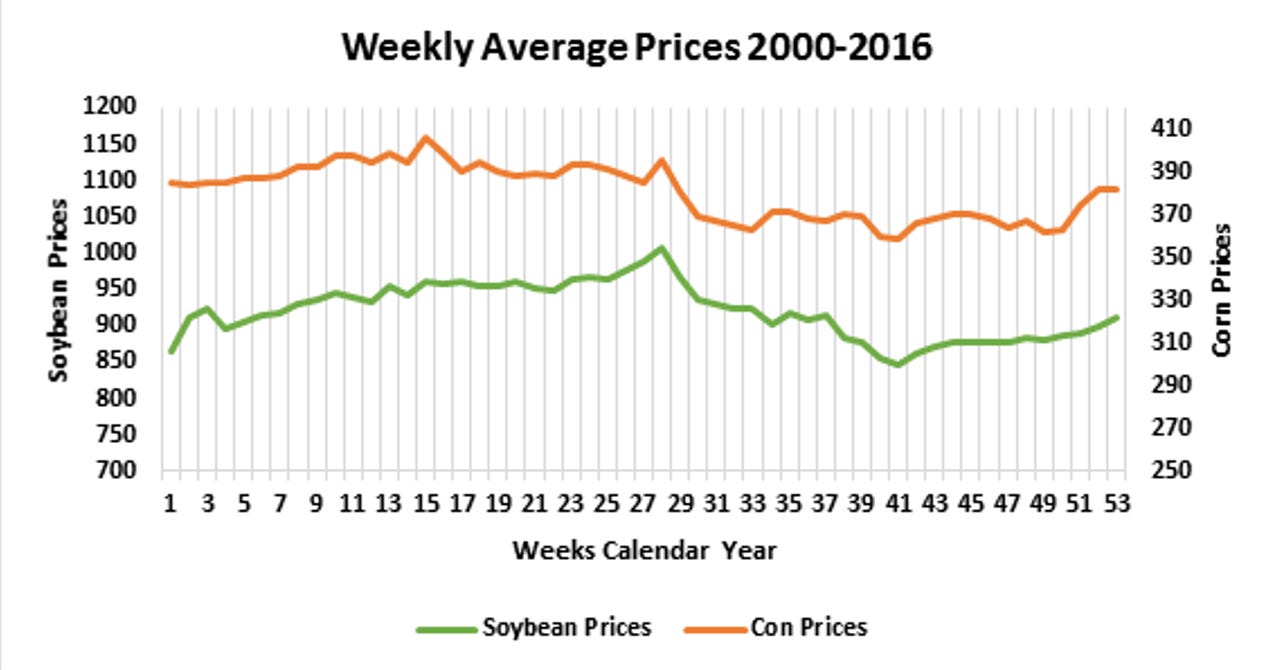

The weekly average price must be seen as a reference of a normal commercial year without any significant supply or demand shocks. It captures the grains seasonality pattern.

Crop Calendar

If we track prices along with the Crop Calendar it’s easier to know at which stage of the commercial year we are at any time. If prices don’t follow the normal seasonality it means that there´s new relevant information from either the demand or supply side. You should expect a commercial year where prices don’t follow their usual seasonality pattern.

Building Blocks

The most important factors use in the analysis of agricultural commodities are:

Supply

1. Current Year Production.

2. Surplus stocks left from the previous year also known as carry in or inventory.

3. Imports from other countries.

Demand

1. Domestic Use.

2. Exports.

Commercial Year Is Key

Soybeans and Corn commercial year starts on September 1st. The 2015-2016 commercial year starts on September 1st 2015 and ends August 31th 2016. A minor but important trick is to arrange all your data, like exports, Commitment of Traders data, and price data so that they all start on a commercial year basis instead of the calendar year. Big players like producers, elevators, and grain processors will make most of their trading decisions this way.

Grains Seasonality

You’ve probably heard that commodities prices follow a seasonality pattern, Grains are no exception to this. It makes sense for prices to be low when the harvest just finished and there isn’t enough room to store all the grain. The only option left for a producer is to sell his bushels.

Also notice that the farmers have bills to pay. They also have to pay interest on the loans they acquired to finance the year’s crop. So the first part of the crop going out to the market is probably going to pay all of their production costs. But since everybody is doing that, supply outweighs demand and prices sink lower.

On the other side of the spectrum, the month before harvest only the grains in storage from last year’s crop are available, Supply is tight, and if something goes horribly wrong with the current year´s crop, prices should spike higher.

Keep in mind grain seasonality isn’t a perfect indicator. Not all years will follow this price behavior.

Grains As A Story: How To Follow The Narratives For A Commercial Year

Planting Season - April To June

It all starts on the last day of May with the USDA prospective planting report. Producers will reveal their intention for the new crop. This is the first key information the market will receive regarding this year's crop.

Next, everybody will follow the planting pace on the Crop Progress report which is published every Monday by the USDA. If pace is within the average, nothing happens. But if rain or other types of delays happen, the planting pace starts to deviate from the average and production concerns will start to fester.

(Corn and Soybeans have an ideal window of planting. If they are not in the ground by this time, yields will suffer.)

This will continue until the USDA Acreages reports are out in June. By this time the market knows how much acres of Corn and how many of Soybeans are effectively on the ground.

Grains on the Ground - July To August

The next big thing will be yield. If you know how many acres are planted, and if you also know how much corn each acre will give you, you will able to calculate the size of this year´s production.

Crop progress will show if the grains are in great, good, or bad condition. This is the time when grains are most susceptible to weather, the number one risk in this market.

This time of the year is when you can expect high levels of volatility. Traders have more opportunities to speculate since prices can change rapidly. Weather news is really important during this period.

The Harvest - September To November

Next is harvest season. The Crop Progress report will show the pace at which the grain is being picked up from the ground. Just like in the planting pace, the market expects it to be close to average. If it goes too fast, it could imply a short term supply glut. And if it goes too slow it could lead to quality issues.

Rains aren’t friendly at this point, besides slowing the harvest pace, they could damage perfectly good crop, or damage its quality, and as usual the market will focus on weather.

Demand Market - December To January

Now that the harvest is done, the supply driven market will turn into a demand driven market. Everybody will focus on the weekly exports report.

The expectation is for good numbers and a great start to the commercial year. If exports are strong it means the market is healthy and everything is going smoothly.

If bad weather impacts distribution and exports that’s actually bearish for the CME grain contracts. Since the grain cannot be delivered people will buy it from other sources.

No More Information Left - February To March

The market will keep an eye on demand for the time being until February. At this point everything is known like the size of the crop, and how the demand is shaping up. Unless some new story comes into play, there is not going to be new key information released for a while. The markets tend to be quiet until it’s planting season once again.

The whole cycle then repeats.

Grains Are Almost Never Buy and Hold

Whenever you’re trading grains, you’re trading the specific crop condition for that year. (Supply and demand expectations for that year.)

When you buy a company it´ll (hopefully) still be there after one year, 5 years, 10 years, etc. It´s not like their buildings and infrastructure will suddenly disappear out of thin air. Market conditions can change, like new competitors, or new consumer preferences, but a company can adapt and still be in business. If it has added value through time you should be rewarded with a higher price for the stocks you own.

Grains on the other hand are literally destroyed every year. This condition is known as “Fungible” and is a property of most commodities. It means that in order for it to be used it must be destroyed. If you want more Corn it needs to be created from the ground once again. You can't reuse an old crop.

Every time a crop is destroyed or (used) you will be trading whatever is left in inventories plus the next crop’s conditions and expectations. The new crop will have a completely different set of circumstances than what happened a year before.

For the new crop, demand could be growing at a faster rate than production. Or maybe there´s a huge weather threat this year that wasn’t around last year.

These characteristics are what give grain prices their seasonality.

So unlike a business that grows and adds value, corn can´t add value. Therefore it makes no sense to hold corn in a portfolio for years at a time.

It´s important to remember that each time you step into this market you are trading the specific conditions and expectations for that year’s crop plus what´s available in storage.

The only time you’re going to want to hold grains for over a year is when a Food Crisis hits. A really bad crisis can take years for the production side to solve.

Seasonality Tricks

On a normal year October 1st, or the first Friday of October is the lowest price point for the Soybeans and Corn.