Dirty Dozen: Buy 'em...

The evidence has tipped for the bulls. It's time to be loading up.

What we commonly call “success” (rewards, status, recognition, some new metric) is a consolation prize for those who are both unhappy and not good at what they do. ~ Nassim Taleb

Summary: Last week, we discussed how markets were at a significant inflection point, suggesting a big move was coming, but things could break either way. We said we leaned bullish but needed to see bonds put in a floor. We think that has happened, so we are buyers here. Sentiment is nuked in bonds and precious metals. Both look interesting here. Also, we’re playing for some short-term reversion in USD, which we’re expressing through long GBPUSD.

The MO portfolio officially closed things out with a +50.4% return on the year. The team and I will be publishing our eoy review soon, where we’ll dive into our painful mistakes and total blunders, as well as the things we’ve learned and what we’ll try to do better in the year ahead. So keep an eye out for that. And if you’d like to join our Collective as we tackle 2025 head on, just click here.

Alright, let’s get to it.

Radioactive bonds… BofA’s Flow Show Summary with highlights by me.

Bond sentiment and positioning have been absolutely nuked. TLT short interest is at highs, the SI ratio is at its highest level since the 21’ bottom, and 3m rolling fund flows show a dash for the exits.

As far as I can tell, the most consensus narrative right now is “higher for longer / inflation is sticky, and hockey sticking higher / economy is humming / Fed shot themselves in the foot with the Sep 50bps cut, etc…) Considering the above it’s interesting that bonds have rebounded off their 3yr support level.

This smells like like a bottom to me.

4. To the bond bears' credit, we are seeing a good deal of inbound data shooting the lights out, such as the Philly Fed Biz Outlook and New Orders below. Granted, this is soft data, meaning both come from survey data. Survey data has become increasingly unreliable as more and more of us fall prey to the scourge of “political brain,” where we can’t help but see reality through red or blue-tinted glasses.

Regardless, this isn’t bearish. Optimistic sentiment can translate into more CAPEX, greater borrowing, more spending, etc… All good things.

5. When we crosscheck the above with hard data points, we get a more nuanced picture. Here’s the 12m sum YoY chart of US heavy truck and auto sales. This is a reliable growth and recession lead. Now… this is still above levels where I’d become concerned about a recession. But it is pointing to a softening economy, one that is less driven by the vibes above and more impacted by the reality of high rates.

6. We split the difference and expect a goldilocks regime, one with low but positive growth and falling to stable inflation that’s around target. And this will probably be coupled with a continuation of the extreme narrative pendulum swings we’ve seen over the past year, where we go from imminent recession to Fed done screwed up this time, 70s inflation here we come…

Which all makes for a great trading environment.

Last week, we discussed how the market was at a major technical inflection point and how price could break either way. Well, over the weekend, I laid out in a note to our Collective how the evidence has solidly tipped in the bulls' favor. So, we are once again buyers here, focusing on long BTCUSD, QQQ, and precious metals.

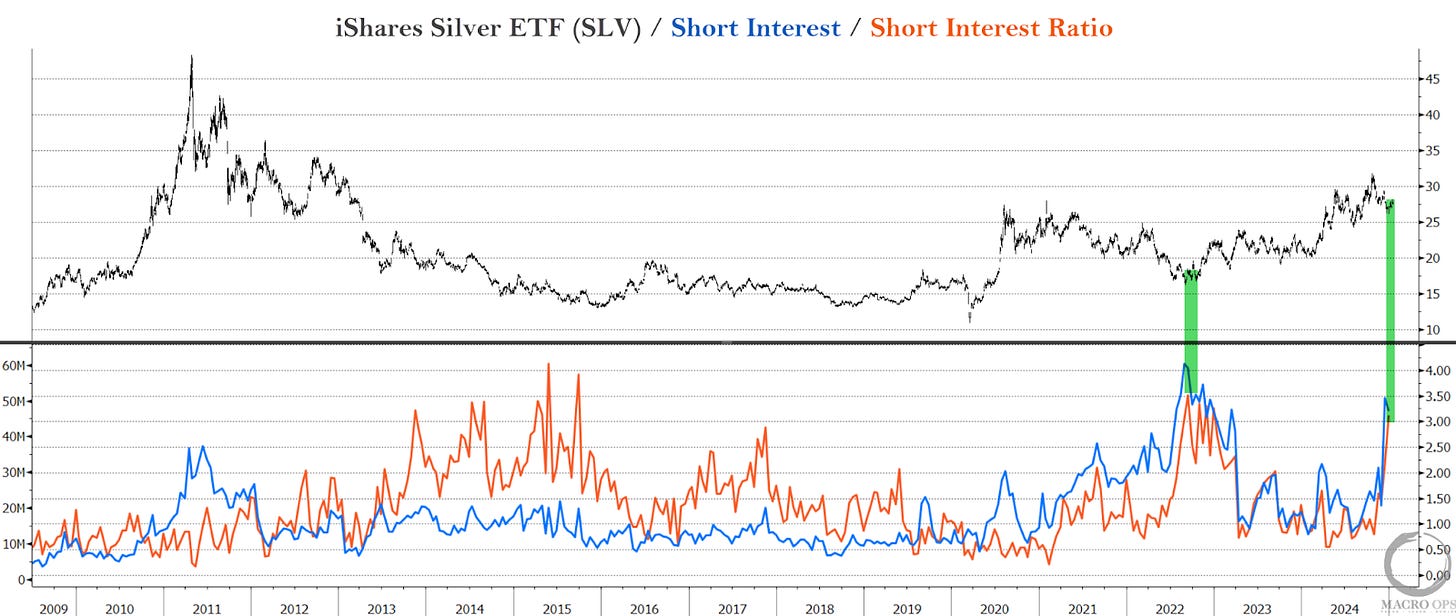

7. Speaking of PMs, it looks like the sentiment in silver is washed out as well.

8. Our 6m CoT Oscillator shows both large and small specs recently dipped below the 10% level, triggering a CoT buy signal.

9. We’re already long gold and putting in buy-stop orders on silver futures to see if the market can pull us in long. And we’re also looking to get back into APM and IDR. Two stocks that we made a boatload on last year. You can read Brandon’s deep dive into APM here.

10. BBG’s Simon White pointed out the heightened risk perception of the British economy. Sharing his Risk Monitor, which consists of UK vs. US & German bond spreads, asset swap spreads, equity relative performance, basis swaps, bank CDS prices, and GBP crosses.

Simon’s risk monitor spiked close to the same levels hit during the Liz Truss fiasco.

11. This panic mode tracks with what we’re seeing in the CoT and sentiment data. GBPUSD is reversing off a significant level here and the tape is more than 2std oversold across multiple timeframes.

12. We’ve put in buy stops right above yesterday’s highs with a risk point nested in below the recent swing low. Let’s see if the market will pull us in.

If you’d like to join the Collective, our premier service that offers discussions on high-level theory and performance, differentiated research, real-time trade alerts, portfolio tracking, and a global community of serious traders/investors dedicated to mastery, then click the below and sign up. We look forward to seeing you in our Slack!

Thanks for reading.

Your Macro Operator,

Alex

Small typo in #10 unless "asses swap spreads" is an exciting, although controversial, new product.