ChemoMetec A/S (CHEMM) designs, develops, and produces instruments for various applications in cell counting and evaluation in Denmark and internationally.

CHEMM is one of the most impressive businesses we've ever researched. Its products serve as the foundation for nearly all genetic/cell research. Customers love how it removes manual errors in cell counting. The FDA makes it almost impossible to switch to another product.

It's no surprise then that the stock's generated a 66.6% 10YR return CAGR with 42% ROCs and 38% ROEs. As Yen Liow would say, CHEMM is a proper horse.

Yet like most horses, CHEMM has always looked expensive. It still looks expensive.

We'll reveal why CHEMM has the opportunity to generate another 10YR period of market-beating returns for shareholders.

In this essay, we'll discuss the following:

Cell Counting & Its Importance in Genetic Research

CHEMM's Business Model and Customer Value Proposition

CHEMM's Competitive Advantages & FDA Stickiness

Valuation Scenarios

CHEMM is a great business with long industry tailwinds and very sticky customers. It's about time we bring it out from the shadows and see what it’s all about.

Industry Overview: Cell Counting As The Foundation

Cell counting is how scientists, researchers, and labs count dead or alive cells in various types of tissues and/or organisms.

Shen Lin-Gibson succinctly described the industry best in his summary white-paper on cell counting practices (emphasis mine):

"Cell-based technology is a fundamental pillar of modern biotechnology. Cells are used in drug discovery and validation, in the production of lifesaving medicines and high value materials, and more recently, as the therapeutic product itself, often referred to as cell therapy products (CTPs).

With the development of CTPs, there is an increased need for high quality, robust, and validated measurements for cell characterization. This measurement, conducted routinely for over a century, underpins key decisions in the manufacturing and commercialization of cell based products.”

In other words, cell counting is the foundation for all gene therapy work.

Consensus estimates assume the global cell counting market will reach ~$17B by 2027, representing ~7% annual growth. We can also use the global gene therapy market as a proxy for future cell counting growth.

For example, the gene therapy market is expected to reach $350B+ over the next ten years. This creates a long runway with solid tailwinds for the foundational cell counting technology.

Let's zoom in and focus on CHEMM's business model.

CHEMM's Business Model: Razor/Razor-Blade

CHEMM operates a three-segmented business model selling instruments, consumables, and services.

Think of the instrument and consumables segment as a classic razor/razor-blade model where CHEMM sells the instruments at low margins and consumables/software services at high margins.

The company sells four primary devices: NucleoCounter NC-202, NucleoCounter NC-200, NucleoCounter NC-250, and the NucleoCounter NC-3000 (see below).

The consumables segment includes disposable cassettes or counting chambers.

Here's how CHEMM's instrument and cassettes work (via website).

“Cell samples to be analyzed are sucked directly into the cassette. Dyes are not added manually, because they are deposited within the cassette during production.

The cassette containing the cell sample is then placed in the NucleoCounter instrument and the rest of the analysis is performed automatically.

The cell count results are available after a short while, and the software used to control the entire process is compliant with the strict FDA requirements for handling digital data.”

CHEMM's cassettes are single-use only, which creates an organic, annuity-like demand for such high-margin consumable products.

Finally, CHEMM offers its customers a wide range of services, including software, test kits, reagents/excipients, licenses for assays, and service contracts on its instruments.

Each product segment builds on one another to create an elegant and highly profitable business model.

The cell counter instrument acts as a lead generator to sell labs and researchers higher-margin products and services like consumable cassettes or software analysis packages (hence the 90% gross margin).

Customer Value Proposition: No Human Error

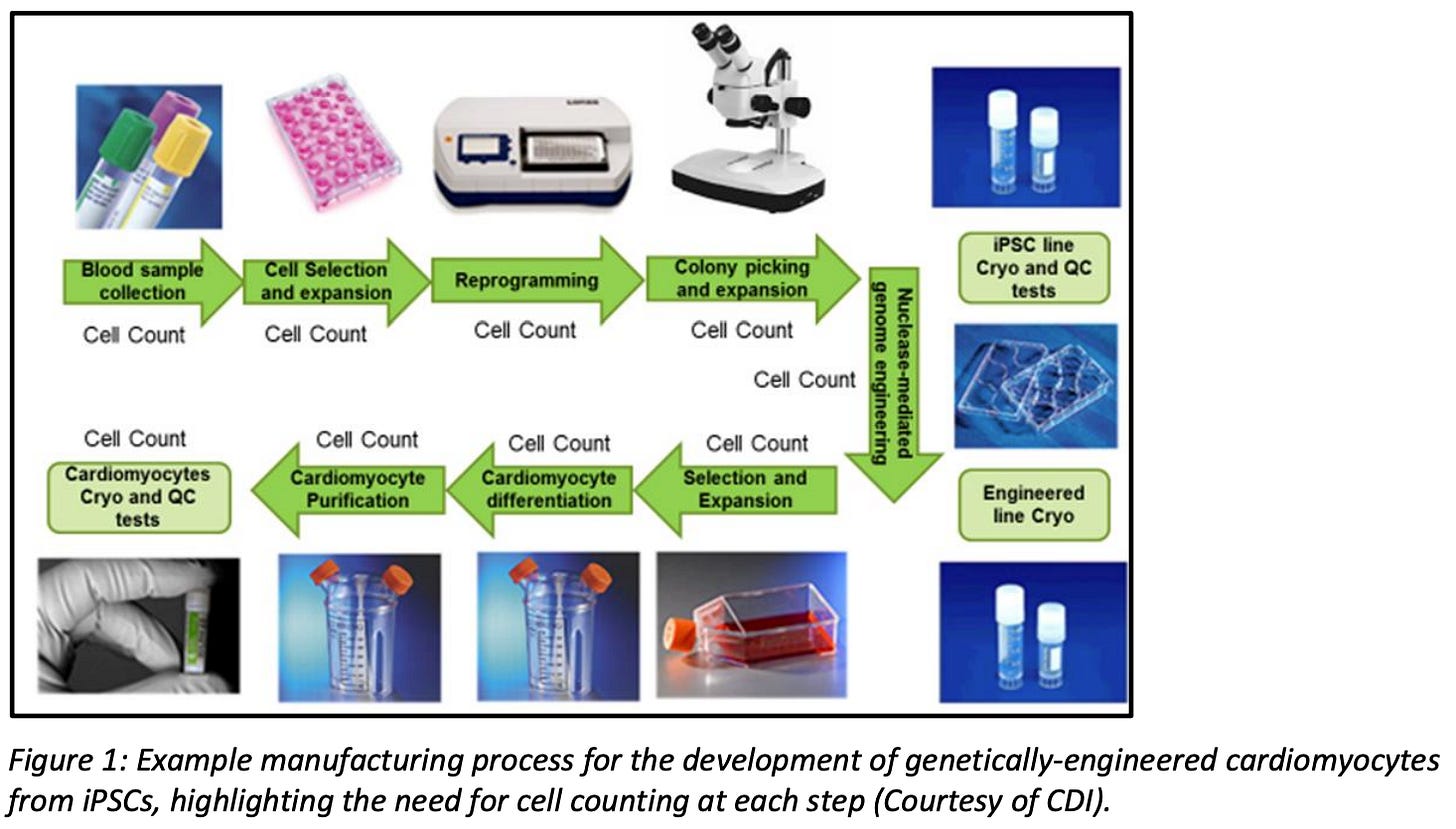

As we mentioned earlier, cell counting is fundamental to nearly every biotechnology we know today. The image below highlights the importance of cell counting at each stage of the research process.

The above illustration is one of many cell counting application examples.

CHEMM's most important market is cell-based therapy, with four main customer segments:

Research & Development

Hospitals and Laboratories

Pharmaceutical and Biotech companies

Manufacturing companies

CHEMM's products help customers count and analyze myriad cells for scientific and consumer applications. For example, private/public R&D and hospitals use CHEMM in gene therapy and stem cell research.

Pharmaceutical and biotech companies also use CHEMM for cell-based therapy and gene therapy and the product and process of cells (bioprocessing). Even manufacturing companies use CHEMM to analyze animal semen and aid in beer production.

We can also examine the customer value proposition through CHEMM customer testimonials (emphasis mine):

“We need to use a cell counting device that is FDA-compliant and capable of counting adipose-derived regenerative cells rapidly and efficiently. After testing several options, we found that the NucleoCounter® NC-200™ device fits our required criteria and consistently delivers rapid, reproducible and reliable results.

We did not have to perform any additional validation studies related to cell counting and viability due to the FDA’s familiarity with the instrument. Selecting the NC-200™ as our automatic cell counter saved us time during the FDA application as well as during training of the staff at the clinical sites.

The quality of the device and the excellent customer service that ChemoMetec provides has been a key factor in the successful initiation of our clinical program.” - Glenn Winnier, Ph.D., Chief Scientific Officer.

Then there’s Ghee Kim, an Associate Director of Engineering Process Development, explaining CHEMM’s benefits (emphasis mine):

“We have decided to use the NC-200™ for our development studies, clinical manufacturing and commercial manufacturing moving forward because it provides better cell counts than the competitors, primarily due to the aggregation that occurs with our HEK293 cell line.

Cell count is one of the primary parameters that we will be measuring, especially for GMP production. Without an accurate cell count, our seeding and target cell densities could be off and affect the expansion of our cells.”

The company enjoys a dominant market share in the cell counting industry. Management's internal estimates put the company's market share around 15-25% of total cell counting revenue.

Let's see what makes CHEMM's products so much better than its peers.

CHEMM’s Three Main Competitive Advantages

Three main competitive advantages drive CHEMM's bull thesis.

Stricter Compliance and Process Documentation Requirements

CHEMM's equipment is typically used in highly-regulated environments (hospitals, etc.) with diverse internal and external requirements.

Plus, institutions want to use equipment that already meets/passes such regulations and standards, which CHEMM's products provide.

Need For Workflow Homogeneity

Whenever researchers engage in cell counting, the overall workflow often needs to be approved. This means that the individual parts, including the instruments used for cell counting, must remain the same.

It is an expensive headache to change analysis methods after an overall approval has taken place.

Increased Allocation To Cell Counting

Many customers within ChemoMetec’s business areas generally allocate more resources for cell counting to ensure proper compliance and documentation.

Together, these three competitive advantages create one of the stickiest products/services we've ever seen in a company.

As we'll see below, CHEMM's switching costs only increase as its customers and end-markets grow.

How The FDA Creates Insanely High Customer Lock-In

CHEMM is one of the stickiest businesses we've come across, largely thanks to the FDA. The FDA has highly regulated the cell counting practice. Labs must pass droves of compliance requirements and documentation specifications to safely (and legally) engage in cell counting.

CHEMM's products are highly integrated within the FDA's compliance processes and regulation standards. The FDA's familiarity with CHEMM instruments makes it a logical choice for labs and researchers compared to its competition.

Better familiarity means faster compliance and regulatory approvals, which means a shorter time to research and less money wasted on red tape.

In turn, CHEMM benefits from one of the most robust customer lock-ins (switching costs) we've seen in any business. Here's how it works. CHEMM's relationship with the FDA incentivizes more customers to use the product.

More customers using the product creates familiarity within cell counting workflows and procedures, further deepening the FDA's intimacy with CHEMM products.

Finally, a stronger relationship between the FDA and CHEMM instruments incentivizes new customers to choose CHEMM over competitors as more of their peers use the products.

CHEMM is an excellent example of Brian Arthur's "Customer Groove-in" theory. I explained the idea in my piece on Increasing Returns To Scale (emphasis mine):

"Once you train a customer how to use a product with a steep learning curve, each incremental update requires less training and a stickier user base. This means products that gain market share in the initial adoption phase have a greater tendency to take more share as the market expands. Thus locking in customers."

We can see customer lock-in in CHEMM's financials.

The company's gross margins increased from 84% to 90% over the last five years. During that time, CHEMM has expanded operating (EBIT) margins from 11% to 41%.

Recent Business Performance

CHEMM grew revenues 31% despite adverse COVID conditions. The company also increased EBITDA by 46% and expanded EBITDA margins by 433bps to 42%.

Instrument sales grew 20%, while consumables sales increased 29%. We can view Instrument sales as a leading indicator of future consumables revenue (razor blade model).

What's interesting to note is that CHEMM's services business (licenses, software, test kits, etc.) increased 220% and now comprises ~10% of total revenue. That said, 90% of the company's revenue comes from its Life Science & Bioprocessing Markets (LCB).

Over time, CHEMM should generate a higher share of total revenue from its software and services businesses. Again, it uses its hardware devices (instruments and cassettes) to offer its sticky software solution and embed the entire CHEMM ecosystem into a customer's highly regulated workflow.

Thinking About Valuation

CHEMM is optically expensive by any quantitative metric imaginable. The company trades north of 50x revenues and over 100x EBIT.

Leaving short-term valuation figures aside, what could the long-term (10 years) look like? We ran three future scenarios: Base, Bear, and Bull.

Base Case

Our base case assumes ~26% top-line revenue CAGR, 89% gross margins, and 41% EBIT margins. Importantly, we estimated substantial multiple compression over the next decade as CHEMM converges to a more realistic (yet still premium) EBIT and sales multiple.

For example, our base case assumes EV/Sales multiple compression from 58x to 7x and an EV/EBIT multiple compression from 142x to 30x.

We end 2031 with $460M in revenue, $414M gross profit, and $190M in EBIT. That gets us a fair value market cap between $3.2B and $5.7B, or $184/share to $326/share. If we take the average of both fair values, we will get a 10YR IRR of ~5.86%.

Next, the bear case.

Bear Case

There aren't many fundamental holes to poke in CHEMM's business model. But at the current market price, the bears have excellent quantitative reasons for their skepticism.

Our bear case assumes ~17% top-line revenue CAGR, 86% gross margins, and 38% EBIT margins. Both gross and EBIT margin assumptions fall below historical estimates and would signal a market share/pricing power loss.

Then there's multiple compression. Our bear case assumes EV/Sales and EV/EBIT multiples compress from 58x to 5x and 142x to 20x, respectively.

We end 2031 with $221M in revenue, $182M in gross margin, and $82M in EBIT. That gets us a fair value market cap between $1.1B and $1.64B, or $65/share to $95/share. In other words, a -5% 10YR IRR.

Finally, the bull case.

Bull Case

CHEMM is a fantastic business with pricing power, sticky customers, and a long runway for organic revenue growth. Our bull case reflects optimistic futures by assuming 33% top-line revenue CAGR, 92% gross margins, and 43% EBIT margins.

We're still assuming aggressive multiple compression from current levels. Our bull case takes 2031 EV/Sales and EV/EBIT multiples of 10x and 35x, respectively.

We end 2031 with $780M in revenue, $717M in gross profit, and $340M in EBIT. That gets us a fair value market cap between $7.8B and $12B, or $449/share and $691/share.

If our bull case estimates are remotely correct, CHEMM's stock will generate a ~25% 10YR IRR from its current price.

Concluding Thoughts: CHEMM Is A World-Class Business

CHEMM is a great business that will likely always look optically expensive. You can argue that today's prices are too high, and you'd be right. Meanwhile, CHEMM's addressable market continues to grow at an 8% clip. At the same time, its core function (cell counting) stands as the most foundational aspect of all genetic research/therapy applications.

Even in our most bullish scenario, CHEMM captures roughly 5% of its addressable market. That pales in comparison to management's own estimations of 15-25% market share.

But what if CHEMM's management team is right in their estimates? What if CHEMM captures 15% of all cell counting revenue over the next ten years? That would turn CHEMM into a $2.6B revenue business at 90% gross margins with >40% EBIT margins.

CHEMM has every ingredient necessary to generate above-average returns for the next decade, even at today's prices. It's an elegant example of a world-class business commanding a world-class price.